massachusetts estate tax return due date

Only about one in twelve estate income tax returns are due on April 15. The due date for filing the estate tax returns.

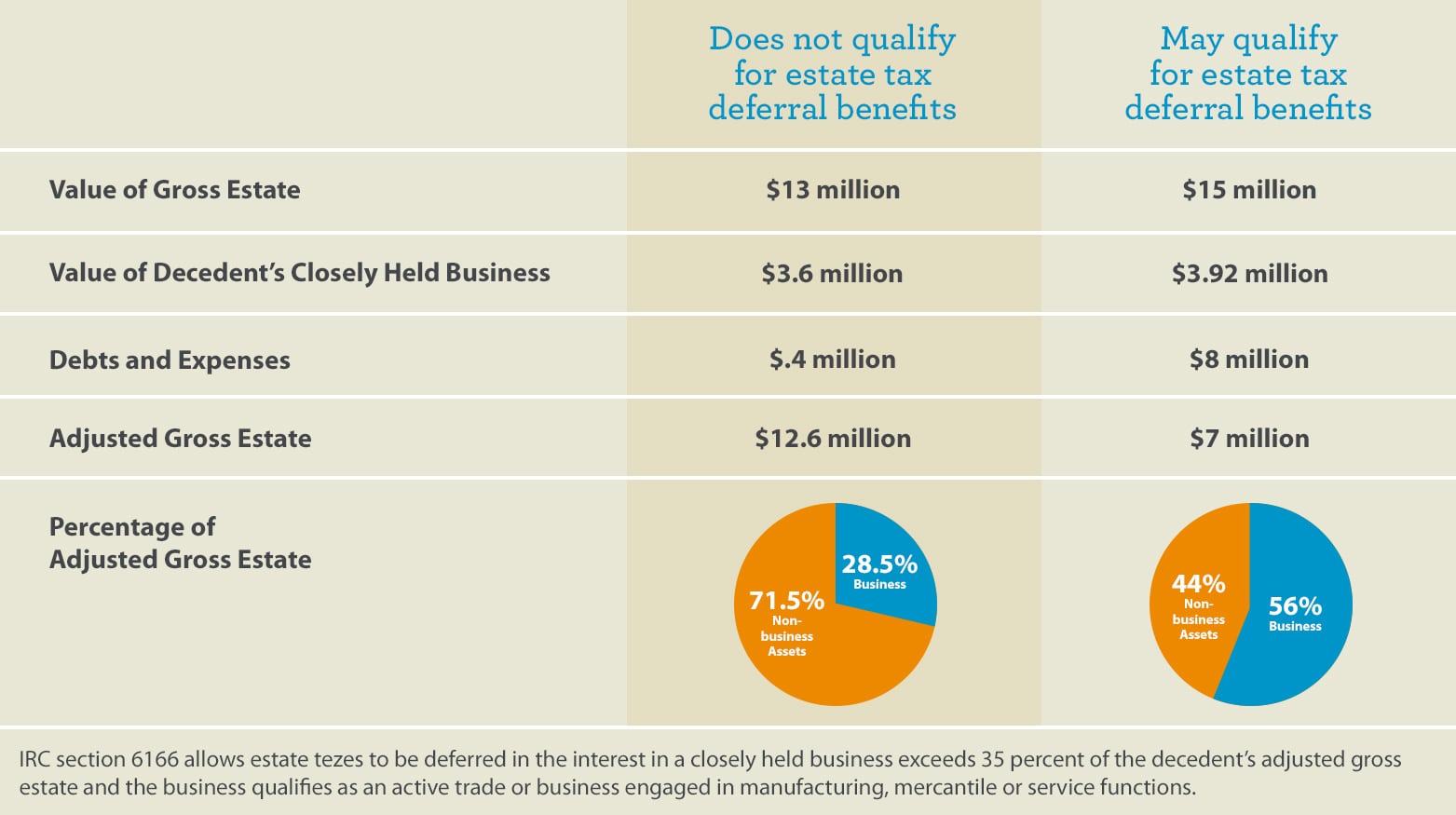

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations

The Massachusetts estate tax law MGL.

. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. It depends on the. US Estate Tax Return Form 706 Rev.

Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. In general if the decedent earned enough income in the final year of life to require filing final income tax returns the final returns for a calendar year taxpayer are due on April 15th.

If a return is required its due nine. Estate tax returns and payments are due 9 months after the date of the decedents. The final return for Massachusetts will cover the income received by the decedent up until date of.

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. 3 However not every estate needs to file Form 706. Massachusetts uses a graduated tax rate which ranges between.

For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death. The estimated amount of tax.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. The Massachusetts estate tax for a resident decedent generally. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

Up to 25 cash back Even if a Massachusetts estate tax return must be filed it doesnt necessarily mean that the estate will owe estate tax. Download or print the 2021 Massachusetts Form M-4768 Massachusetts Estate Tax Extension Application for FREE from the Massachusetts Department of Revenue. The following is the review of Massachusetts estate tax returns.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. 1 The Final Taxes Form 1.

The Massachusetts estate tax is a. The gift tax return is due on April 15th following the. Specifically the person appointed to serve as the personal representative of an estate must file what is known a Massachusetts Estate Tax Return Form M-706 if the.

2006 through the present 1 million. The Application for Extension of Time to File Massachusetts Estate Tax Return Form M-4768 must be filed prior to the due date for the M-706. For decedents dying after 2002 the Massachusetts estate tax thresholds varied from year to year as follows.

If youre responsible for the estate of someone who died you may need to file an estate tax return. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable.

Only to be used prior to the due date of the M-706 or on a valid Extension. December 31 2000 see Massachusetts Estate Tax Return Form M-706.

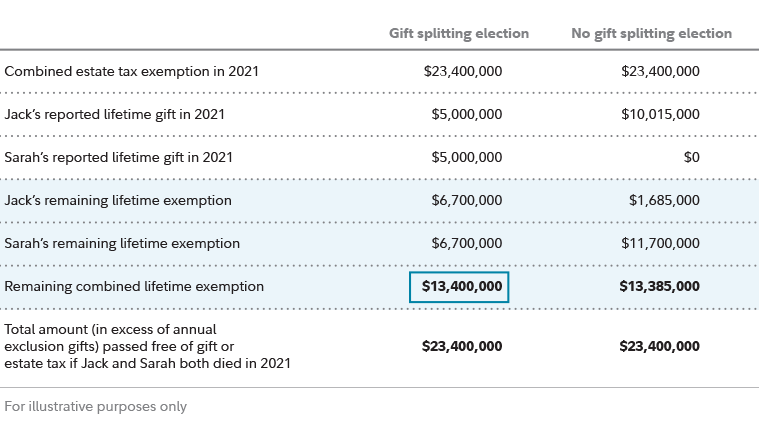

Estate Planning Strategies For Gift Splitting Fidelity

When To File Form 1041 H R Block

401 K Inheritance Tax Rules Estate Planning

Irs Announces Higher Estate And Gift Tax Limits For 2020

Basic Tax Reporting For Decedents And Estates The Cpa Journal

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Estate Tax Exemption 2021 Amount Goes Up Union Bank

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Don T Forget The 65 Day Rule March Deadline As An Opportunity For Tax Savings Preservation Family Wealth Protection Planning

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

A Guide To Estate Taxes Mass Gov

Great Website For Printables Including Printable Ledgers Choose Paper Size And Columns Etc Paper Template Free Accounting School Planner Printables

How To Avoid Estate Taxes With Trusts

A Guide To Estate Taxes Mass Gov

How Do State Estate And Inheritance Taxes Work Tax Policy Center